Here at Wonga, we've long been synonymous with quick and easy personal loans in South Africa, providing tailored financial solutions with lightning-fast turnaround times. As the fintech landscape evolves, we're committed to revolutionising the borrowing experience, making it even quicker and simpler for our customers.

Building on our legacy of speed and innovation, our customers can apply for a loan in just one-click. This feature is currently available exclusively to our existing customers, and with just a single click, our customers can access instant decisions, ensuring peace of mind that their financial needs can be met swiftly and effortlessly.

In pursuit of our commitment to offering a swift, effortless, and hassle-free financial experience, we've enhanced our self-service capabilities. Now, our valued customers can track their loan applications seamlessly from inception to completion, providing them with real-time updates. This upgrade not only ensures transparency but also offers peace of mind by keeping customers informed every step of the way.

Let's Get Started

The Wonga Legacy - Speed and Accessibility

Wonga has long been a trusted resource for countless South Africans seeking prompt financial support. Renowned for its intuitive online interface and swift approval procedures, Wonga has cemented its position as a leading provider of quick and easily accessible personal loans. Thanks to our user-friendly platform, customers can effortlessly apply for loans in a matter of minutes, with funds swiftly deposited into their accounts shortly thereafter. This convenience makes Wonga the ideal solution for tackling unforeseen expenses or handling emergencies with ease.

Innovation for our Customers - The One-Click Journey

While Wonga has been a trailblazer in the realm of fast personal loans, our platform takes speed to the next level. Customers can now access funds with unprecedented ease and efficiency, thanks to our seamless digital interface. With just a single click, users can complete their loan applications and receive approval within minutes.

Efficiency Through Technology

Behind the scenes, our platform leverages state-of-the-art technology to streamline the lending process, we can swiftly evaluate creditworthiness, bypassing the need for extensive paperwork and manual reviews. This means that our customers receive decisions instantly, granting them access to funds precisely when they need them the most.

Transparency and Trust

While speed is essential, we understand that transparency and trust are equally crucial. We are committed to providing customers with clear and transparent terms and conditions. Our platform ensures that users have full visibility into interest rates, fees, and repayment terms, empowering them to make informed financial decisions.

Easy Self Service Options

In our ongoing commitment to improving the loan experience and ensuring customer satisfaction, we've enhanced our self-service capabilities, granting customers access to comprehensive account management tools. Our goal is to simplify the process, providing customers with clear insights into the status of their loans from initial application through to receiving the funds in their bank account.

Faster Options with Seamless Self-Service

As we continuously strive to simplify our loan experience and reduce reliance on traditional phone calls, we're excited to introduce quicker options for effortless self-service.

Here's how we're making your journey smoother and faster:

Streamlined Application Process

For existing customers, applying for a loan is now as easy as a single click, eliminating unnecessary steps and saving you precious time.

- Existing Customers can apply in just One Click!

Here’s how: Our system updates now allow you to apply for a loan with just one click if all your previous application details are the same.

You do have the option to update your details if your information has changed.

Real-Time Application Tracking

Stay informed about the status of your loan application with real-time updates, ensuring transparency and peace of mind throughout the process.

- See your loan application status in real-time!

Here’s how: In the My Loan section of your account, you can see your loan application progress. It will give you a breakdown of where your application is in our approval process.

![]()

Get a Breakdown

Know what’s happening with your loan application at any time!

- How to Check your Loan summary and Loan documents

Here’s how: In the Loan Summary section, your hub for managing loans. Here, access two key features: Loan Summary and Loan Documents.

Loan Summary: Track current and past loans, stay updated on balances.

Loan Documents: Easily retrieve statements and paid-up letters for your records.

Convenient Access to Loan Summary and Documents

Easily locate your loan summary and related documents, providing you with clarity and convenience at your fingertips.

- Check your Statements under Loan documents tab

Here’s how: Once you click on Loan documents, you will be able to view your loan statements and also download them.

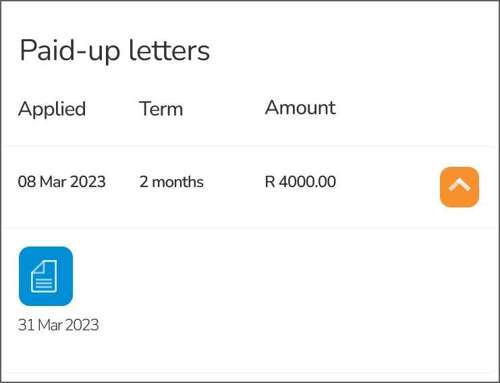

Quick Access to a Paid-Up Letter

Retrieve your paid-up letter instantly from the loan documents tab, ensuring easy access whenever you need it.

- Download your Paid-up letters under the Loan documents tab!

Here’s how: Once you have settled a loan, a paid-up letter for that loan will automatically appear in the Loan documents section. You can download the paid-up letter by clicking on the relevant dated icon.

At Wonga, simplicity is key when it comes to lending. With effortless self-service features and a streamlined one-click application process, we're dedicated to enhancing the experience. Our mission? To elevate our customers' loan journey by providing lightning-fast access to funds, ensuring peace of mind precisely when it's needed the most.